Axios

June 19, 2021

Barriers to Black capitalism

When a bank turned down George Johnson for a business loan in the 1950s, he got creative. He returned and told the bank he needed $250 to take his wife on a vacation — and was approved.

Then he invested the cash in his business, which became the first Black enterprise to trade on the American Stock Exchange, Axios’ Russell Contreras and Fadel Allassan write.

Why it matters: Highways to success in the U.S. market economy — in entrepreneurship, corporate leadership and wealth creation — are often punctuated with roadblocks and winding detours for people of color.

The story of how that agile entrepreneur created Johnson Products exemplifies the barriers Black Americans face in building businesses a century after slavery and decades after Jim Crow laws.

Born in a three-room sharecropper’s shack in Mississippi, Johnson dropped out of high school and worked as a door-to-door cosmetics salesman.

Johnson and his wife, Joan, used their “vacation loan” and another $250 loan from a friend to create a hair relaxer for men in the 1950s, then promoted their products in Black-0wned magazines and newspapers.

Eventually, the personal care products company vastly expanded after advertising on “Soul Train,” the American music-dance television program created by Don Cornelius, another Black risk-taker.

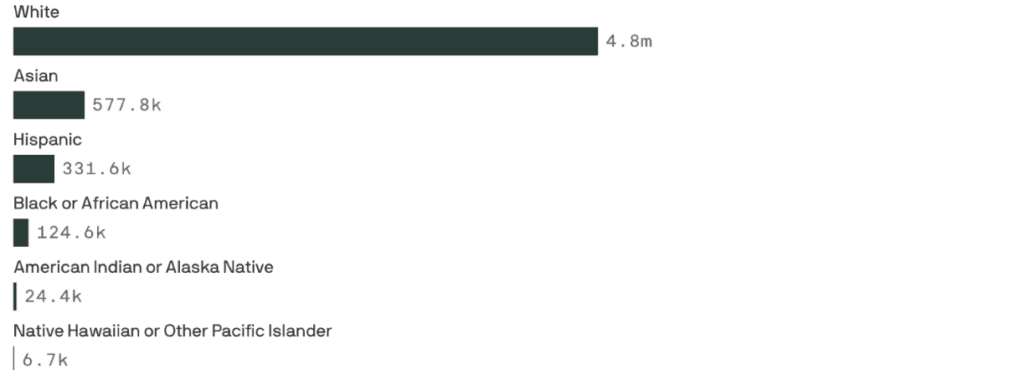

Data: Census Bureau, Annual Business Survey. (Hispanic respondents also identify with a racial group, so they are double-counted.) Chart: Connor Rothschild/Axios

Only 18.3% of American businesses are minority-owned, according to the Census Bureau, despite minorities comprising 40.3% of the population, Axios’ Dan Primack and Kia Kokalitcheva report.

Why it matters: Business ownership can create wealth. And wealth begets wealth.

The inequality may be even more severe than the numbers suggest, since they were compiled before the pandemic. Businesses owned by Black, Latino and Asian Americans were decimated in 2020.

The National Bureau of Economic Research estimates that the number of Black business owners decreased by 41% between February and April 2020. The number of Latino business owners fell by 32%, Asian business owners declined by 26% and white business ownership was off by 17%.

One reason for the higher closure rate is that minority-owned small businesses tend to have smaller cash buffers than do white-owned small businesses. And the New York Fed notes that many Black-owned businesses are concentrated in cities hit hard by the virus.